| StockFetcher Forums · Stock Picks and Trading · A Newbie's Journey | << 1 ... 13 14 15 16 17 ... 48 >>Post Follow-up |

| pthomas215 1,251 posts msg #138944 - Ignore pthomas215 |

10/28/2017 3:34:13 PM it's hard to believe but the major institutional call volume is on QQQ, FB, AMZN etc. sure seems like we are going even higher. |

| sandjco 648 posts msg #138951 - Ignore sandjco |

10/28/2017 8:59:47 PM thanks for dropping by PT! yeah...guess this October taught me that not all Octobers will be the same. I just have to trade the signals and maybe scale in on dips given that it appears that there doesn't seem to be a real fundamental trigger that could roil this run (ala financial crisis). Testing things out...bought CWEB at $47.69 using EOD prices.  |

| sandjco 648 posts msg #139234 - Ignore sandjco modified |

11/13/2017 9:36:36 AM SMH...trying not to catch the overtrading disease, I sat when I could have sold $7 higher and re-loaded around here. Now, I wait patiently to add more.... Selling CWEB $52. |

| sandjco 648 posts msg #139237 - Ignore sandjco |

11/13/2017 10:15:21 AM Added at $109. |

| sandjco 648 posts msg #139340 - Ignore sandjco |

11/16/2017 8:53:48 AM added more using $103.50 EOD. Used 4/5 of my powder. Hmmmm  |

| sandjco 648 posts msg #139432 - Ignore sandjco |

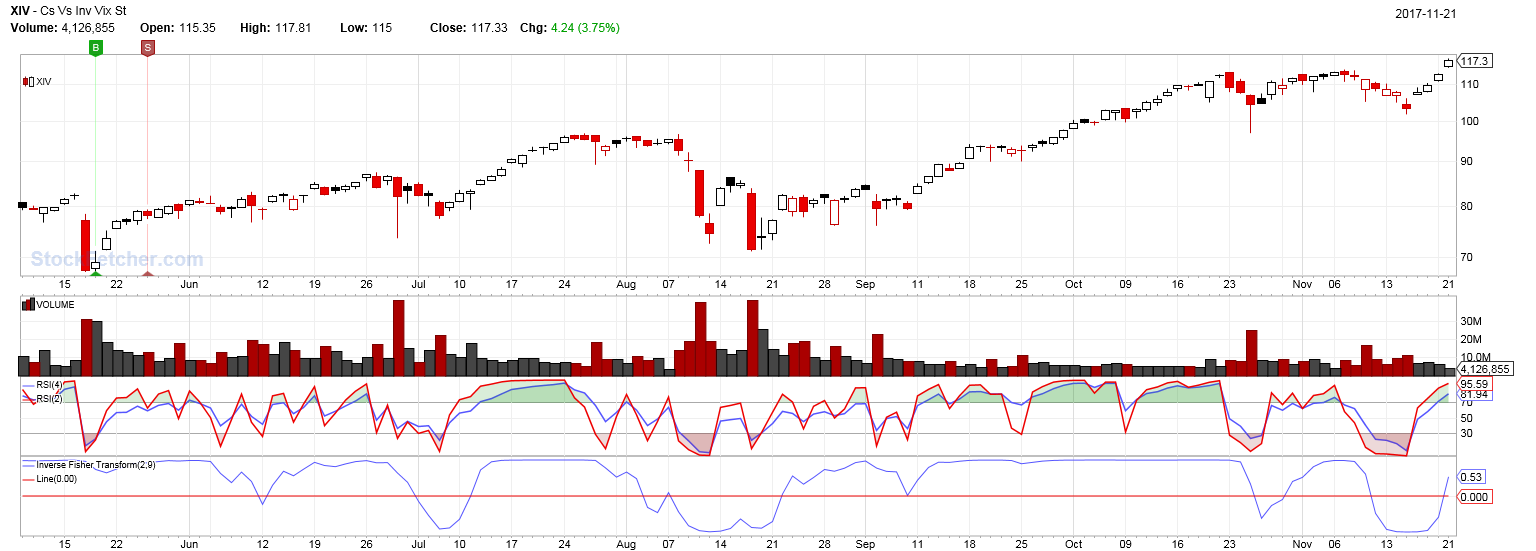

11/21/2017 2:37:34 PM ACB of $106.25. To add or not to add. Looks like a triple top breakout. Greed says...add the last 1/5 tranche. |

| sandjco 648 posts msg #139433 - Ignore sandjco |

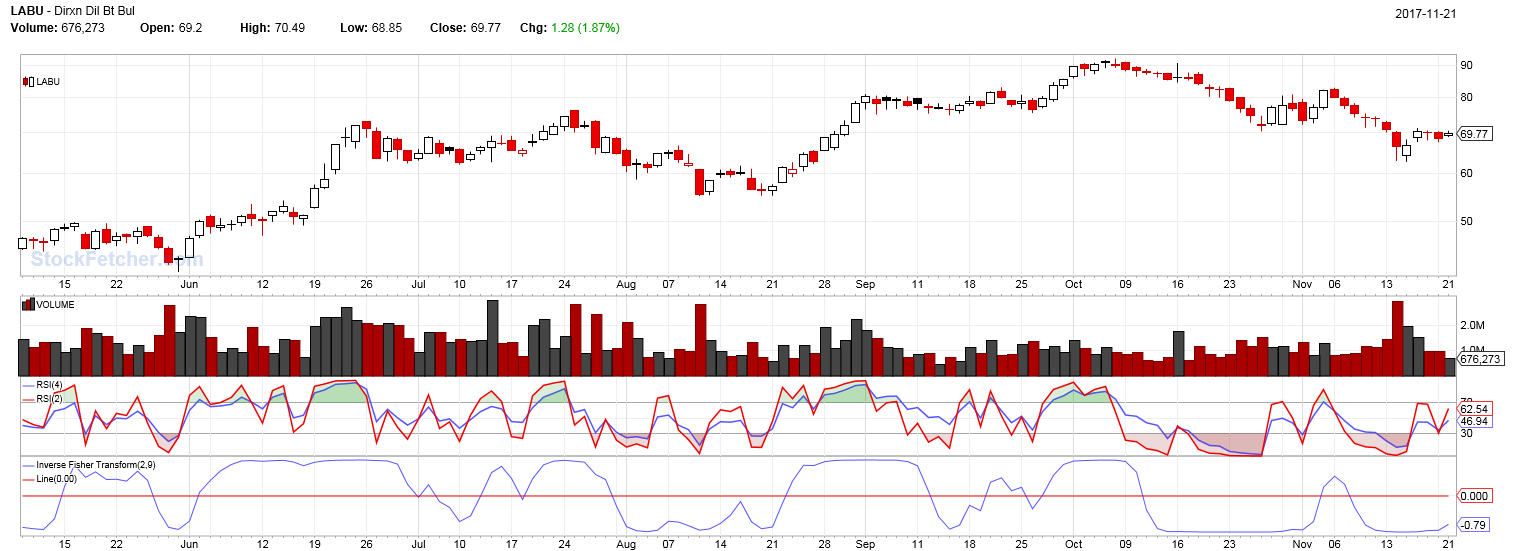

11/21/2017 3:12:23 PM CWEB profit of 9% in 2 weeks  Sold early I guess...in hindsight. XIV mid day  Might pick up LABU instead...  |

| sandjco 648 posts msg #139445 - Ignore sandjco |

11/22/2017 8:41:28 AM Last tranche in at $117.30 using EOD price. Nibbled at LABU with loose change at $69.48 using EOD. |

| sandjco 648 posts msg #139453 - Ignore sandjco |

11/22/2017 12:21:52 PM Question... How do I "chart" the ratio of the result that is generated by this filter? symlist(spy,agg) add column roc(10,1) {performance} Thanks in advance! |

| Kevin_in_GA 4,599 posts msg #139454 - Ignore Kevin_in_GA |

11/22/2017 12:48:22 PM The ratio (or difference, which is what I personally would use) needs to be defined as a variable. Like this when you look at the rocratio curve, you can see why I prefer using the simple difference of the two values. |

| StockFetcher Forums · Stock Picks and Trading · A Newbie's Journey | << 1 ... 13 14 15 16 17 ... 48 >>Post Follow-up |